KYC/AML Compliance

Navigate Compliance with Ease

eZverifi elevates KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance, offering businesses a robust solution designed for accuracy, efficiency, and adherence to global regulations. Our solution empowers your enterprise to verify customer identities, assess risk accurately, and maintain regulatory compliance without compromise.

Unparalleled Compliance and Security

Our comprehensive KYC/AML compliance framework provides you with the tools to meet and exceed regulatory standards, ensuring your operations are both secure and compliant. With eZverifi, protect your business from financial crimes and maintain the trust of your customers and partners.

Stay Ahead of Regulations

Effortlessly navigate the evolving landscape of KYC and AML regulations, ensuring your business remains compliant and ahead of potential risks.

Enhance Due Diligence

Utilize our advanced due diligence processes to thoroughly verify customer identities, monitor transactions, and assess risk with unparalleled precision.

Global Document Verification

Access our extensive database to verify a wide range of identity documents from over 240 countries and territories, ensuring comprehensive global coverage.

Cost-Effective Risk Management

Achieve operational excellence in compliance and risk management at a fraction of the cost, with our efficient, pay-per-verification model.

Navigating the KYC/AML Landscape

In the fast-evolving financial landscape, KYC and AML regulations have become cornerstones of modern business operations. Failing to comply not only poses legal risks but can also damage your reputation among customers. Stay ahead with eZverifi, and ensure your business remains protected and compliant.

Why Choose eZverifi for KYC/AML?

Advanced Fraud Prevention

With just a few clicks, identify and prevent fraudulent activity, securing your business and fostering genuine customer relationships.

AI-Powered Compliance

Leverage cutting-edge AI technology for a high degree of automation in compliance checks, making compliance management both efficient and reliable.

Global Compliance, Local Insight

Our solution is designed for global operations, with multi-language support and local regulatory knowledge, enabling you to expand securely into new markets.

Continuous Monitoring and Updates

Stay updated with real-time screenings against global sanction and PEP watchlists, and ongoing monitoring for any changes that may affect your compliance status.

Streamlined Compliance Processes

Our KYC/AML compliance solution simplifies complex regulations into straightforward, actionable insights:

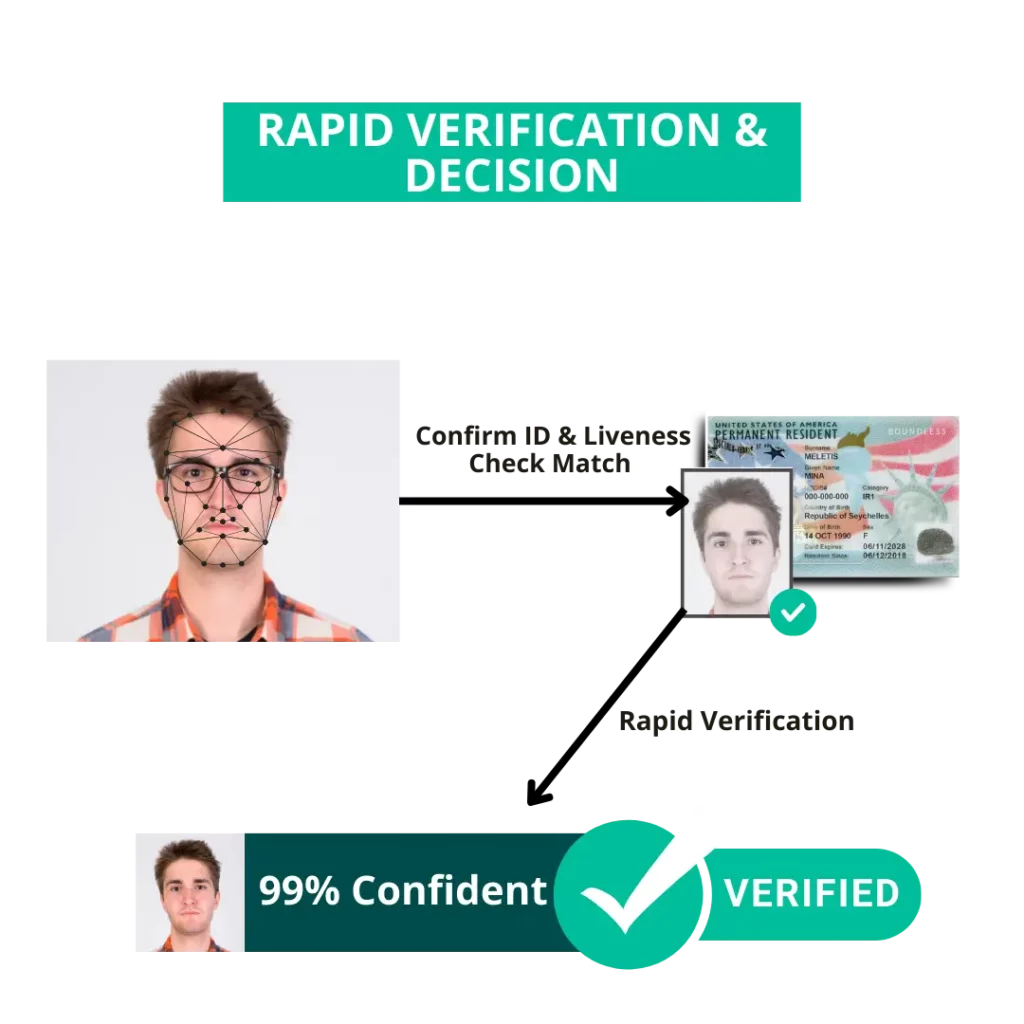

How KYC Verification Works

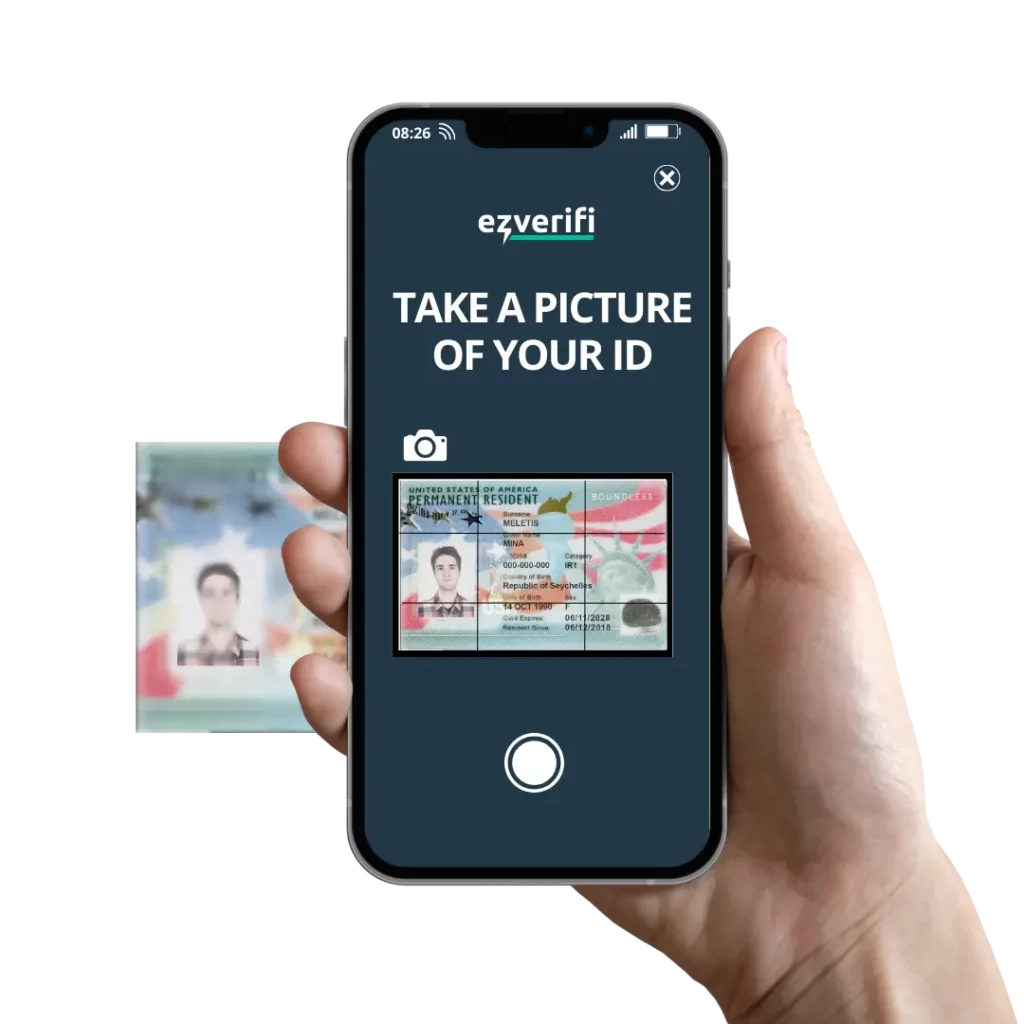

Step 1

User takes a photo of their identity document

eZverifi streamlines ID verification with smart guidance and real-time feedback, ensuring accuracy without manual input.

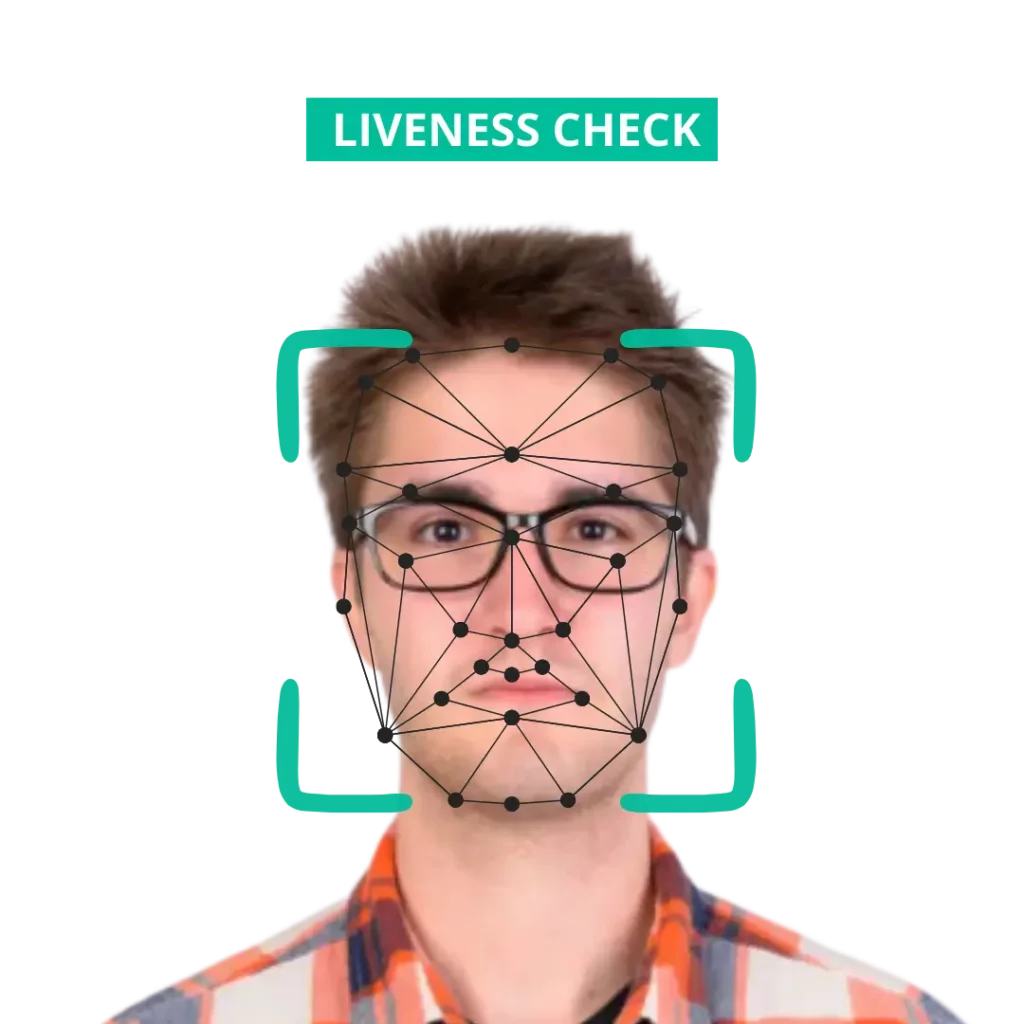

Step 2

Liveness and Authenticity Check

Our technology confirms user presence through a simple selfie, verifying authenticity without complicating the process.

Step 3

Decisioning

eZverifi quickly processes data using AI, delivering swift, accurate verification decisions customized to your needs.

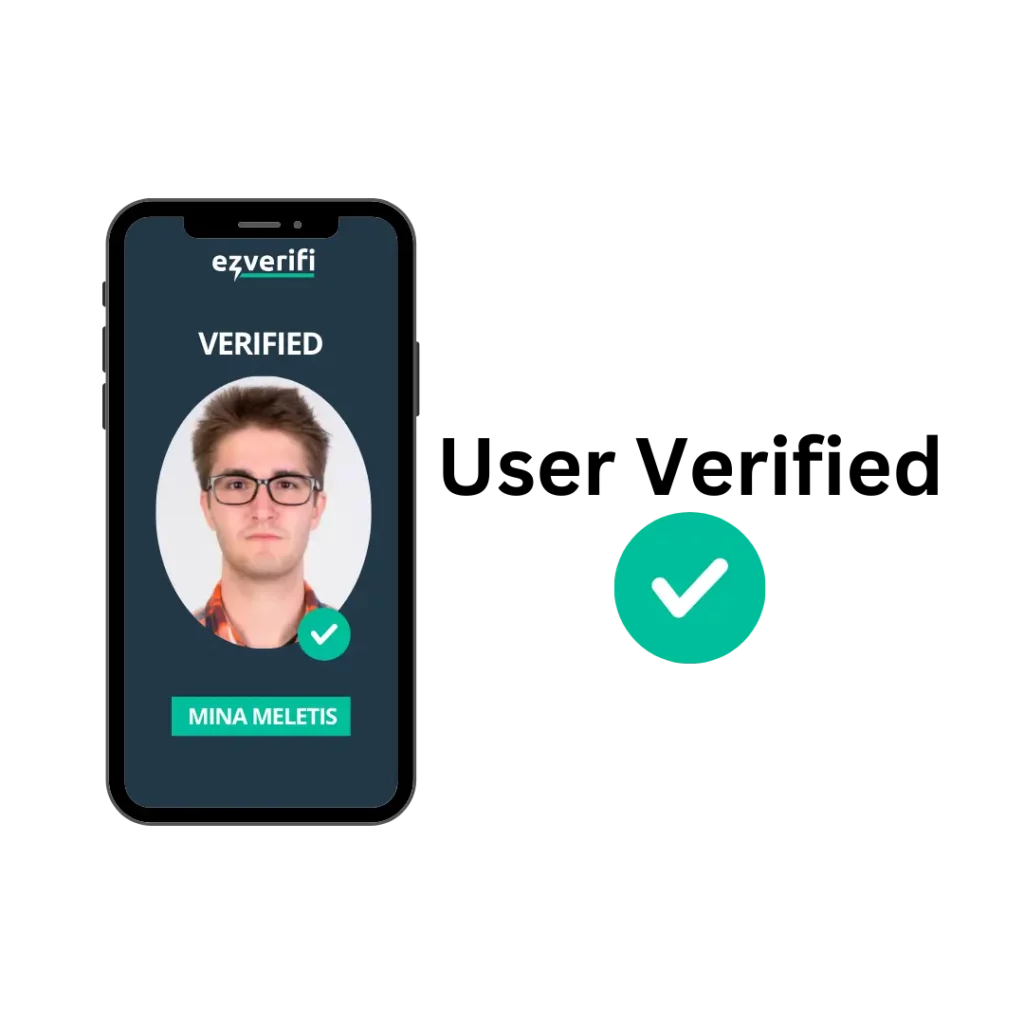

Step 4

User Verified

With AI at the helm, eZverifi ensures a smooth onboarding process by providing rapid, secure verification outcomes.

The Imperative of Secure Compliance

For business owners, the stakes of KYC/AML compliance have never been higher. In an era where digital transactions are king, ensuring the security and legality of each transaction is paramount. Let eZverifi be your shield against compliance risks and fraud.

Empowering Compliance with Advanced KYC/AML Solutions

In-depth Sanction and PEP Screening

Stay ahead with our comprehensive watchlist screening, ensuring up-to-the-minute awareness and compliance.

Adverse Media Checks

Safeguard your business reputation with extensive scans for potential risks across global media.

Automated Verification & Screening

Enhance accuracy and streamline compliance with our automated identity verification and screening process.

Dedicated Compliance Support

Gain an edge with our continuous monitoring and expert support, keeping your strategy proactive and informed.

Advanced Screening and Continuous Monitoring

In-depth Sanction and PEP Screening

Screen customers against thousands of global watchlists with real-time updates, ensuring you're always informed.

Adverse Media Checks

Conduct comprehensive scans across numerous media sources to identify potential risks and protect your business reputation.

Automated Verification & Screening

Swiftly verify identities and screen against global watchlists with our automated system, ensuring accuracy and compliance.

Dedicated Compliance Support

Benefit from continuous monitoring and expert support, keeping your compliance strategy proactive and informed.

Customizing Compliance to Elevate Your Business

Tailored Verification for Every Business Model

Recognize the uniqueness of your business with our customizable KYC/AML solutions, ensuring a perfect fit for your operational needs and customer interactions.

Build Customer Trust and Loyalty

Strengthen relationships with thorough verification processes that highlight your commitment to security and compliance, fostering trust and loyalty among your customers.

Navigate Regulatory Landscapes with Confidence

Seamlessly adapt to the ever-changing regulatory environment with eZverifi’s expert guidance, ensuring your business remains compliant and forward-thinking.

Expand Your Market with Global Reach

Embrace global opportunities with confidence. Our comprehensive document verification enables you to meet compliance demands worldwide, providing the support needed to tap into new markets.

Unlock the Potential of Compliant Growth

Propel your business forward by leveraging eZverifi’s KYC/AML solutions. Start safeguarding your operations, building trust, and exploring new horizons today.

Easy Compliance Steps

Follow these three simple steps to enhance your KYC/AML compliance with eZverifi.

Specify Your Needs

Identify your specific compliance challenges and how eZverifi can address them to enhance your security.

Consult eZverifi

Contact us for a tailored consultation that aligns our solutions with your business requirements.

Partner with eZverifi

Fill out the contact form to initiate your compliance transformation with eZverifi’s expert team.

Take the First Step Towards Seamless Compliance

Discover how eZverifi can simplify your KYC/AML processes, enhance security, and ensure you stay ahead of regulatory changes. Join the ranks of businesses that trust eZverifi to safeguard their operations and reputation. Fill out the form now to learn more about our solutions tailored just for you. Let’s make compliance your strength.

With eZverifi, you will:

Streamline Compliance: Simplify complex KYC/AML regulations into an effortless, streamlined process.

Enhance Security: Protect your business and customers with cutting-edge fraud detection technology.

Get Global Coverage: Verify identities across over 240 countries with a single, comprehensive solution.

Enhance Cost Efficiency: Optimize your compliance spending with our efficient, pay-per-verification model.

Get Expert Support: Gain peace of mind with continuous support from our dedicated compliance experts.

Take the First Step Towards Seamless Compliance

Discover how eZverifi can simplify your KYC/AML processes, enhance security, and ensure you stay ahead of regulatory changes. Join the ranks of businesses that trust eZverifi to safeguard their operations and reputation. Fill out the form now to learn more about our solutions tailored just for you. Let’s make compliance your strength.

With eZverifi, you will:

Streamline Compliance: Simplify complex KYC/AML regulations into an effortless, streamlined process.

Enhance Security: Protect your business and customers with cutting-edge fraud detection technology.

Get Global Coverage: Verify identities across over 240 countries with a single, comprehensive solution.

Enhance Cost Efficiency: Optimize your compliance spending with our efficient, pay-per-verification model.

Get Expert Support: Gain peace of mind with continuous support from our dedicated compliance experts.