-

Products

-

Solutions

-

About

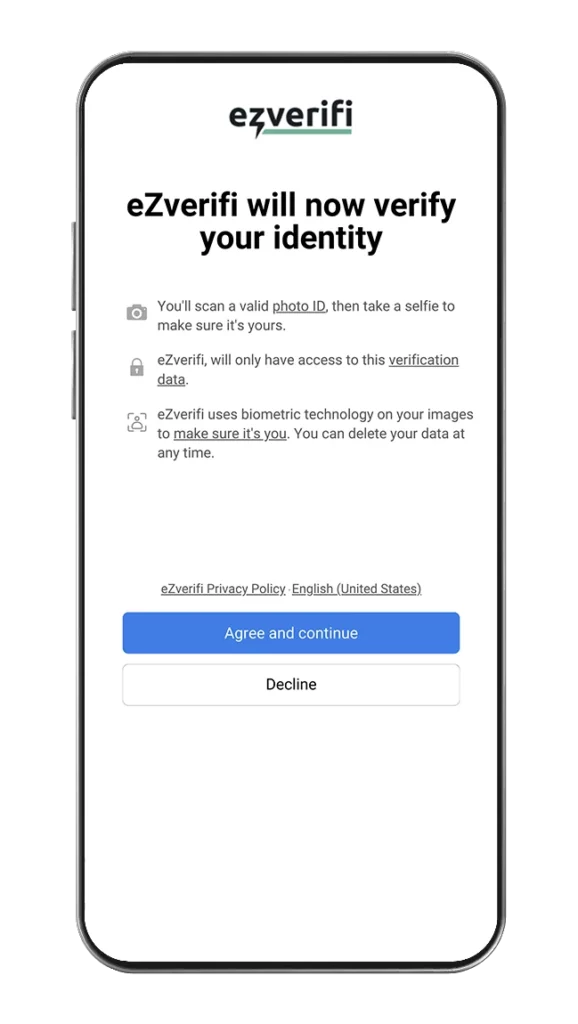

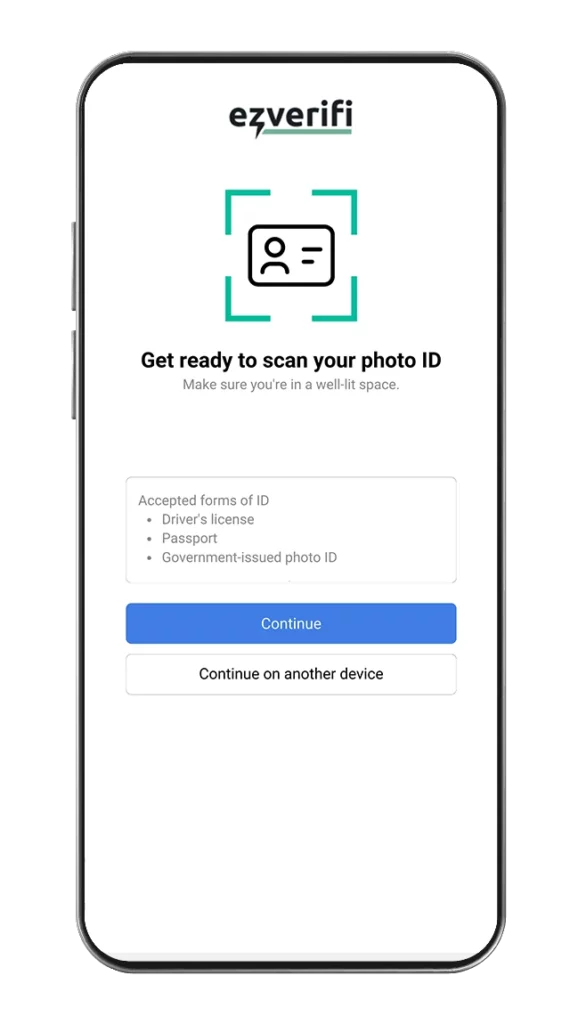

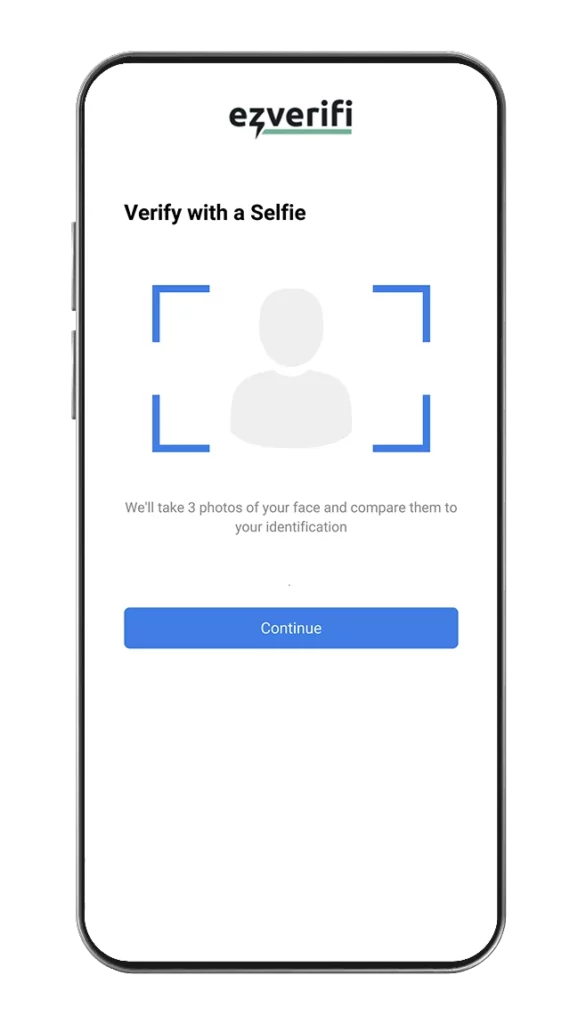

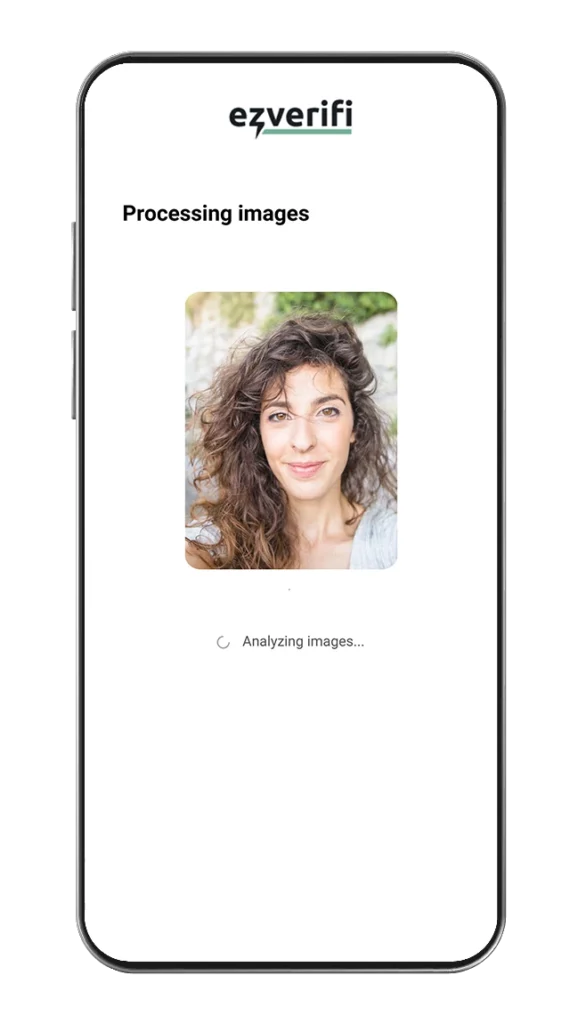

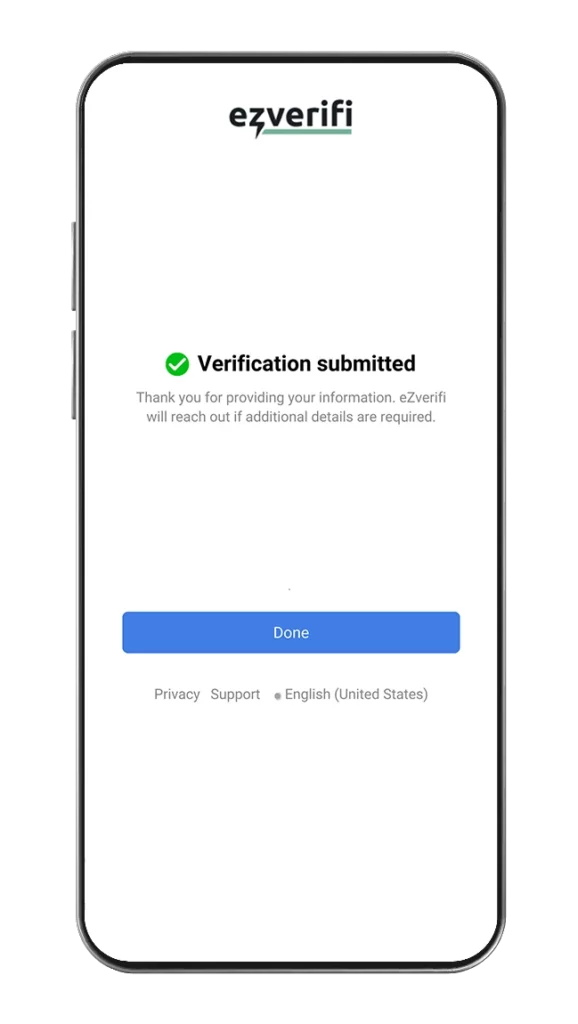

Prevent fraud, build trust, and get more verified customers faster with eZverifi identity verification soultion, Fine tune it for your business.

Explore eZverifi’s solutions tailored for everything from peer-to-peer marketplaces to online gaming, enhancing safety and trust in every interaction.

Uncover eZverifi’s journey, from our origins to our future vision, and meet the people and values shaping our commitment to secure, connected communities.